June 11, 2020

AAP APRIL 2020 STATSHOT REPORT: PUBLISHING INDUSTRY DECLINES 3.5% FOR MONTH, FLAT YEAR-TO-DATE

The Association of American Publishers (AAP) today released its StatShot report for April 2020 reflecting reported revenue for all tracked categories, including Trade (consumer publications), K-12 Instructional Materials, Higher Education Course Materials, Professional Publishing, and University Presses.

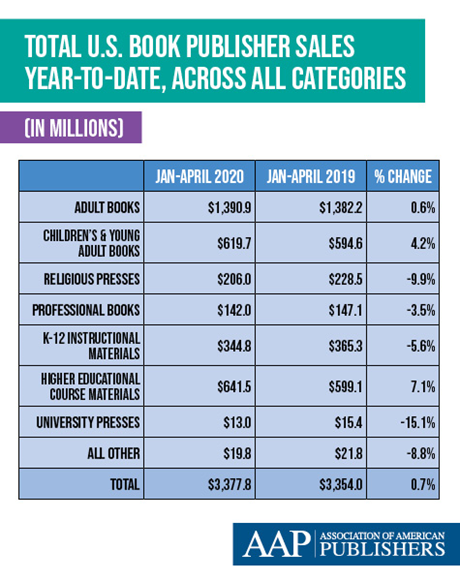

Total sales across all categories for April 2020 declined 3.5% as compared to April 2019, reaching $783.9 million. Year-to-date sales were flat with an increase of 0.7%, totaling $3.4 billion for the first four months of 2020.

Trade (Consumer Book) Revenues:

Trade sales were down 6.6% as compared to April of 2019, coming in at $548.8 million. Year-to-date Trade sales were flat at +0.5%, totaling $2.2 billion for the first four months of the year.

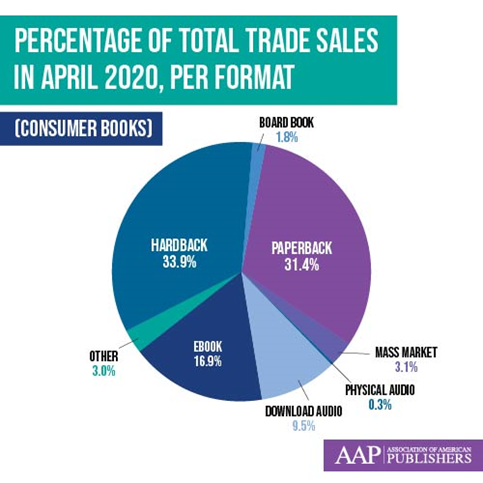

Physical paper formats in the Trade (consumer publications) category saw declines during the month, with hardback revenues falling by 12.9%, Paperback declining by 8.7%., Mass Market down 15.9%, and Board Book revenues dropping 3.2%. Overall, physical formats declined by 11.0% for the month, coming in at $385.6 million. On a year-to-date basis, physical formats were flat, down 0.3%, and coming in at $1.6 billion.

Downloaded Audio continued to grow during the month of April, with an 8.0% increase as compared to April of last year, reaching $52.3 million in revenue. On a year-to-date basis, Downloaded Audio was up 14.8% as compared to the first four months of 2019, with a total of $204.8 million for the year so far. The Downloaded Audio format has seen continuous growth every month since 2012.

eBook revenues jumped 10.7% as compared to April 2019 for a total of $92.9 million, bucking a long-standing trend of monthly declines. On a year-to-date basis, eBooks declined 1.1%, coming in at $325.1 million for the first four months of 2020.

Education:

In the education sector, revenues from Higher Education Course Materials jumped 139.8% to $47.6 million compared to April of last year. It should be noted that this net sales increase is being driven by a significant fall in returns, down 57.9% for the month. AAP expects an increase in returns in future months as stores, distributors, colleges and universities re-open. Year-to-date revenues were up 7.1%, coming in at $641.5 million.

PreK-12 Instructional Materials dropped 1.2% to $129.4 million compared to April of last year, and year-to-date revenues in the category fell 5.6%, coming in at $344.8 million.

Professional Books, including business, medical, law, technical and scientific, declined 25.9% for the month, generating $26.7 million, and declined 3.5% year-to-date, with $142.0 million in revenue during the first four months.

University Presses declined 51.4% as compared to April of 2019, bringing in $1.7 million in revenue. On a year-to-date basis, University Presses declined 15.1%, bringing in $13.0 million for the first four months of 2020.

# # #

AAP’s StatShot

Publisher net revenue, including sales to bookstores, wholesalers, direct to consumer, online retailers, etc., is tracked monthly by the Association of American Publishers (AAP) and includes revenue from about 1,360 publishers, with participation subject to change over time.

StatShot reports are designed to give an up-to-date snapshot of the publishing industry using the best data currently available. The reports reflect participants’ most recent reported revenue for current and previous periods, enabling readers to compare revenue on a year-to-year basis within a given StatShot report.

It is not, however, possible to make apples-to-apples comparisons to StatShot reports issued in previous years because: a) The number of StatShot participants fluctuates over time, with the pool of participants growing or shrinking in each report and b) It is a common accounting practices for businesses, including publishers, to restate revenue numbers based on updated information. If, for example, a business learns that its revenues were greater in a given year than its reports indicated, it will restate the revenues in subsequent reports, providing information that is more up-to-date and accurate.