June 15, 2017

AAP StatShot: Book Publisher Trade Sales Flat for 2016

Religious Presses and Childrens & Young Adult Books saw increased revenue; all other measured categories declined

Print books return to growth in hardback and paperback formats, and board books saw nearly double-digit growth

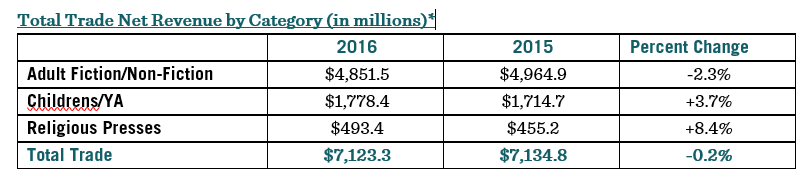

Washington, DC; June 15, 2017 – Publishers’ book sales for trade (consumer) books from Jan. to Dec. 2016 were flat -0.2% at $7.1 billion. While Religious Presses and Childrens & Young Adult Books (Childrens/YA) saw growth in 2016, the Adult Books category (which comprises more than 65% of all revenue for trade books) saw a 2.3% decline.

Overall publisher revenue for 2016 was $14.3 billion, down 6.6% from 2015. These numbers include sales for all tracked categories (Trade – fiction/non-fiction/religious, PreK-12 Instructional Materials, Higher Education Course Materials, Professional Publishing, and University Presses).

Publisher net revenue is tracked monthly by the Association of American Publishers (AAP) and includes sales data from more than 1,200 publishers (#AAPStats). A more detailed analysis of 2016 will be available with the StatShot Annual Report, which includes information from more than 1,800 publishers and market modeling, and will be available for purchase.

Some of the 2016 trends include:

- Reading preferences continue to shift. Print books saw growth, and for the second consecutive year publisher revenues from eBook sales declined and downloaded audio grew.

- Trade publishers fared better than educational or scholarly publishers, who saw declining revenue.

- Childrens/YA titles and Religious Presses fared better than Adult Books, the opposite of 2015, when Adult Books did well and Childrens/YA and Religious Presses declined.

Trade:

“There’s been a lot of buzz about print books resurgence and this year’s data tells us that readers are enjoying all formats that are available to them, and that includes eBooks and audiobooks. Just like print, eBooks are here to stay and we believe their growth is now stabilized,” said Tina Jordan, AAP’s Vice President, Trade Publishing. “Even when we see shifts in categories and formats, it’s clear that books remain a staple in our lives.”

For the first time in years, publisher revenue for all print formats saw growth: hardback books grew 2.2%, children’s board books grew 7.7% and paperback/mass market grew 4.1% compared to 2015 revenues. The news for digital books was mixed, as downloaded audio continued its double-digit growth from 2015, up 25.8% for 2016 vs 2015 and eBooks continued their decline, down 15.6%.

Trade Formats:

- Within the Adult Books category, which saw revenue decline in 2016 vs. 2015, revenue for downloaded audio was up 24.9%; paperback revenue was up 5.3% for the year; eBook revenue was down 13.9%; and hardback revenue was down 3.7% for the year.

- Within Childrens & Young Adult Books, hardback revenue was up 10.7%; paperback revenue was up 0.9%; board book revenue was up 7.7%; and eBook revenue declined 32.6%.

Chart below depicts Trade Book sales by format from 2011 – 2016.

Educational Materials:

Revenues for PreK-12 instructional materials declined 9.0% to $2.8 billion for 2016, compared to $3.1 billion in 2015.

Revenues for Higher Education course materials declined 13.4% to $3.6 billion for 2016, compared to $4.1 billion in 2015.

Professional and Scholarly Publishing:

Revenues for Professional Publishing, which includes business, medical, law, scientific and technical books and journals, were down significantly, by 20.8% at $628.8 million for 2016. University Press revenues were down 2.5% compared to 2015.

* NOTE: Figures represent publishers’ net revenue for the U.S. (i.e. what publishers sell to bookstores, direct to consumer, online venues, etc.), and are not retailer/consumer sales figures.

About AAP

The Association of American Publishers (AAP) represents about four hundred member organizations including major commercial, digital learning and education and professional publishers alongside independents, non-profits, university presses and scholarly societies. We represent the industry’s priorities on policy, legislative and regulatory issues regionally, nationally and worldwide. These include the protection of intellectual property rights and worldwide copyright enforcement, digital and new technology issues, funding for education and libraries, tax and trade, censorship and literacy. Find us online at www.publishers.org or on twitter at @AmericanPublish.