-

- Date(descending)

- Date(ascending)

-

The Association of American Publishers (AAP) announced a major infringement suit today against the notorious pirate site Anna’s Archive, brought by thirteen publishing companies across the trade, educational, and professional and scientific publishing sectors.

Apress Media, LLC et al. v. Anna’s Archive and Does 1- 10 was filed in the United States District Court for the Southern District of New York seeking permanent injunctive relief for the copying and distribution of millions of infringing files, both books and research journal articles. The works in suit include an extraordinary scope of authorship, including bestselling titles and winners of the Nobel Prize, Man Booker Prize, Pulitzer Prize, National Book Award, Newbery Medal, and Caldecott Medal.

Statement from Maria A. Pallante, AAP President and CEO:

“Anna’s Archive is a brazen pirate operation that steals and distributes millions of literary works while outrageously offering access to AI developers in exchange for crypto payments. To fight back, we must use all available tools and believe this action in U.S. court will make a difference. The unfortunate reality is that creators face a level of digital piracy today that is so staggering it is almost unbelievable—it is an affront to the public interest.”

As detailed in the complaint, the operators of Anna’s Archive explicitly describe themselves as “pirates” who “deliberately violate the copyright law in most countries,” boldly threatening “to take all the books in the world.” Anna’s Archive also mirrors the pirate repositories of Library Genesis and Z-Library, sites that are the subject of court orders in several jurisdictions and included in the U.S. Trade Representative’s “Review of Notorious Markets for Counterfeiting and Piracy.” The complaint cites evidence, including the defendants’ own outrageous blog posts, indicating that Anna’s Archive has been soliciting substantial cryptocurrency payments from large language model developers and data brokers in exchange for high-speed access to its repository of “data,” comprising stolen works of authorship.

The publishers seek a legal judgment against Anna’s Archive for willful copyright infringement as well as injunctive relief to help stop its ongoing damage. The plaintiffs also ask the court to direct third-party internet registries, domain name registrars, data centers, and hosting and service providers to assist in ceasing hosting services for the various domain names under which the defendants operate.

Key passages from the Complaint:

- Anna’s Archive publicly claims to have given “high-speed access” to its illegal collection of more than 140 million copyrighted texts to companies in China, Russia, and elsewhere, many of them LLMs. One court in the Northern District of California recently found that Meta Platforms torrented the contents of Anna’s Archive for use in developing its LLM model Llama. Seeking to capitalize on this market, Anna’s Archive now directly solicits the AI industry to purchase high-speed access to its collection.

- Pursuant to CPLR § 302(a)(3)(i), Defendants regularly do or solicit business in New York State, engage in a persistent course of conduct in New York State, and derive substantial revenue from services rendered in New York State. For example, Anna’s Archive distributes copyrighted content to New York State residents without authorization, and it further accepts payments from New York residents in exchange for faster downloads of infringing content.

- The scale of Defendants’ infringement is staggering. Anna’s Archive was created with the express goal “to take all the books in the world,” and it continues its illegal conduct in pursuit of this unlawful aim.

- Anna’s Archive launched in July 2022 as the “Pirate Library Mirror” (or “PiLiMi”). As Anna’s Archive explained at the time, its original name derived from the fact that the operators “deliberately violate the copyright law in most countries” (i.e., are “pirates”), “focus primarily on written materials like books” (and thus claim to be a “library”), and were then “strictly a mirror of existing” Notorious Pirate Sites. As part of its first project in October 2022, Anna’s Archive mirrored the contents of Z-Library, which it described as “a popular (and illegal) library” and Library Genesis or “LibGen”, one of the world’s largest Notorious Pirate Sites. Anna’s Archive copied over 10 million files from Z-Library and LibGen.

- Defendants directly profit from their mass infringement business. Anna’s Archive seeks donations through its “Donate” page, and it has solicited “other types of support, such as grants, long-term sponsors, high-risk payment providers, perhaps even (tasteful!) ads.”

- Defendants also solicit “[e]nterprise-level donation[s]” in exchange for “[u]nlimited high-speed access” and other services. In reality, these “donations” are paid memberships, and Anna’s Archive explicitly refers to donations as “memberships” on its FAQ page.

- The Atlantic complaint alleged that Anna’s Archive purported to host “61,344,044 books” and “95,527,824 papers” as of the date of filing on December 29, 2025. That Anna’s Archive has apparently added over 2,000,000 books and 100,000 papers in the short time since the Atlantic complaint was filed speaks to the egregious scale of Defendants’ infringement.

About the Association of American Publishers

The Association of American Publishers (AAP) represents the U.S. publishing industry on matters of law and policy, with a particular focus on the copyright, technology, and freedom of expression issues that make publishing possible. Founded in 1970, AAP regularly organizes and supports litigation that is of existential importance to the greater creative community. AAP’s members include large, small, and specialized publishing houses serving both local and global markets. Together, they inform and inspire the public, one work of authorship at a time.

About the Plaintiffs

Plaintiffs in Apress Media, LLC et al. v. Anna’s Archive and Does 1-10 include Apress Media LLC; Cengage Group; Elsevier Inc.; Hachette Book Group, Inc.; HarperCollins LLC; John Wiley & Sons, Inc.; Bedford, Freeman, & Worth Publishing Group, LLC d/b/a Macmillan Learning; Macmillan Publishing Group, LLC; McGraw Hill LLC; Pearson Education, Inc.; Penguin Random House LLC; Simon & Schuster, LLC; Taylor & Francis Group, LLC.

The plaintiffs, and other AAP member publishers, publish and curate the important, beloved, and award-winning works of many of the world’s most acclaimed authors as well as leading educators and experts in various educational, scholarly, and scientific fields. They are global leaders who partner with brilliant authors to deliver works that educate, inform, and inspire every type of reader. Moreover, these publishers are investing in artificial intelligence tools to improve business practices and reader experiences while maintaining emphasis on human authorship as the bedrock of creative and scholarly endeavor.

Read complaint here.

-

AAP Applauds the Agency’s Review of Pirate Sites that are Harmful to Publishers and Authors

Washington, DC; March 4, 2026 —The Association of American Publishers today applauded the release of the 2025 Review of Notorious Markets for Counterfeiting and Piracy by the Office of the U.S. Trade Representative (USTR). The Notorious Markets List identifies prominent examples of online and physical markets around the world “in which pirated or counterfeit goods and services reportedly are available or that facilitate, turn a blind eye to, or benefit from substantial piracy and counterfeiting.”

“On behalf of our member publishers we thank the USTR and the interagency team for its continued focus on Intellectual Property rights, and for the critically important work exposing overseas-based online sites and marketplaces that traffic in infringing copies of books and journal articles,” commented Lui Simpson, Executive Vice President for Global Policy at AAP. “This annual report is an indispensable tool in the ongoing battle to protect the rights of publishers and authors.”

The report highlights the necessity of having an effective framework for dealing with enterprise scale piracy and the complex ecosystem—including “domain name registries and registrars, reverse proxy and other anonymization services, hosting providers, caching services, advertisers and advertisement placement networks, payment processors, social media platforms, search engines, and network management infrastructure—which providers of pirated content abuse.”

The report again lists Libgen, Sci-Hub and their related mirror-sites including several of Anna’s Archive’s domains, which host millions of unauthorized copies of books, manuals, journal articles, academic papers, and other works of authorship. Both the Libgen and Sci-Hub sites are subject to court orders in Belgium, Denmark, France, Germany, Italy, Portugal, Russia, Spain, Sweden, the United Kingdom, and the United States.

The 2025 USTR Notorious Markets report can be found here.

-

March 2, 2026 Read More

Cambridge University Press, Simon and Schuster, and Stanford University Press honored with PROSE Awards for Excellence

Top PROSE Awards Honor, the R.R. Hawkins Award, goes to Cambridge University Press’ Atlantic Cataclysm: Rethinking the Atlantic Slave Trades by David Eltis

The Association of American Publishers (AAP), which is currently celebrating the 50th Anniversary of the PROSE Awards, has announced its 2026 Area of Excellence winners, recognizing an outstanding scholarly publication in each of the following four categories: Biological & Life Sciences, Humanities, Physical Sciences & Mathematics, and Social Sciences.

AAP also announced that the program’s top prize, the prestigious R.R. Hawkins Award, has been awarded to Cambridge University Press’ Atlantic Cataclysm: Rethinking the Atlantic Slave Tradesby David Eltis.

“For fifty years, the PROSE Awards have honored the publishers who deliver the very best in professional and scholarly publishing, and I am delighted to say that the houses behind this year’s Excellence Awards winners have continued that tradition, with stellar works representing all four of the PROSE Categories,” Commented Syreeta Swann, Chief Operating Officer, Association of American Publishers. “Even as we congratulate this year’s exceptional group of honorees, we also applaud each and every PROSE award-winning publishing house that has delivered ground-breaking works over the past half-century. Bravo to all!”

R.R. Hawkins Awards Winner

“Receiving the prestigious R.R. Hawkins Award at this year’s PROSE Awards is a real honour for Cambridge and an extraordinary achievement for David Eltis, whose book Atlantic Cataclysm: Rethinking the Atlantic Slave Trades is rightly recognised for its outstanding contribution to academic scholarship,” commented Mandy Hill, Managing Director, Cambridge University Press. “This award also reflects the shared commitment and close partnership that underpin exceptional publishing. David’s extraordinary scholarship, supported by the dedication and expertise of our publishing team, have enabled us to bring this important piece of work to readers around the world. I’m delighted that the judges have recognised the impact and quality of this work, and I would like to extend my congratulations to all of the winners and finalists.”

“This year’s top honoree, Atlantic Cataclysm: Rethinking the Atlantic Slave Trades, offers a carefully researched, data-driven analysis that dramatically challenges long-held assumptions of the Atlantic slave trade and its aftermath, in the process creating a new understanding of this pivotal period in world history,” commented PROSE Chief Judge Nigel Fletcher-Jones, PhD. “The scholarship and analysis in this work stand out in an already impressive crowd of competitors, and we congratulate Cambridge University Press for producing a work that we believe will swiftly take its place as a touchstone in its field.”

2026 PROSE Excellence Winners are as follows:

R.R Hawkins Award Winner & PROSE Award for Excellence in The Humanities

- Atlantic Cataclysm: Rethinking the Atlantic Slave Trades by David Eltis, Cambridge University Press

PROSE Award for Excellence in Biological & Life Sciences

- Slip: Life in the Middle of Eating Disorder Recovery by Mallary Tenore Tarpley, Simon and Schuster

PROSE Award for Excellence in Social Sciences

- The Worst Trickster Story Ever Told: Native America, the Supreme Court, and the U.S. Constitution by Keith Richotte, Jr., Stanford University Press

PROSE Award for Excellence in Physical Sciences & Mathematics

- Decoherence and Quantum Darwinism: From Quantum Foundations to Classical Reality by Wojciech Hubert Zurek, Cambridge University Press

About the PROSE Awards

Since 1976, the AAP’s annual PROSE Awards have recognized publishers who produce books, journals, and digital products of extraordinary merit that make a significant contribution to a field of study.

During the 2026 PROSE Awards cycle, a prestigious panel of PROSE Awards Judges selected 101 finalists and 37 category winners. Of the 37 exceptional category winners, today’s PROSE Award for Excellence Winners and R.R. Hawkins Award Winner illustrate the highest standards of scholarly publishing, contributing innovative research and impactful scholarship to their respective areas of study.

More information about the 2026 PROSE Awards can be found here.

-

February 23, 2026 Read More

The Association of American Publishers (AAP) unveiled the Finalists and Category Winners for the 50th annual PROSE Awards, honoring professional and scholarly works published in 2025. The PROSE Awards, first presented in 1976, recognize professional and scholarly publishers that have made significant advancements in their respective fields of study each year as judged by a multidisciplinary panel of experts.

“This year we are proud to celebrate the 50th anniversary of the PROSE Awards and delighted to announce that the 2026 finalists and category winners include a tremendously impressive selection of scholarly authorship,” commented Syreeta Swann, Chief Operating Officer for the Association of American Publishers. “We send our congratulations to all of this year’s honorees and look forward to the announcement of the 2026 PROSE Awards for

Excellence winners, as well as the top prize, the R.R. Hawkins Award in the weeks ahead.”

The Category Winners will now be eligible for the next level of PROSE honors – the Awards for Excellence, which will be announced in the coming weeks.

The Awards for Excellence comprise the following:

- The 2026 PROSE Award for Excellence in Biological and Life Sciences

- The 2026 PROSE Award for Excellence in Humanities

- The 2026 PROSE Award for Excellence in Physical Sciences and Mathematics

- The 2026 PROSE Award for Excellence in Social Sciences

The prestigious R.R. Hawkins Award, the PROSE Award’s highest honor, will be presented to one of the four Excellence winners.

The full list of 2026 Finalists and Category Award winners can be found here.

-

February 11, 2026 Read More

Trade (Consumer Book) Revenues Up 14.2% for Month of December, and Down 0.5% Year-to-Date

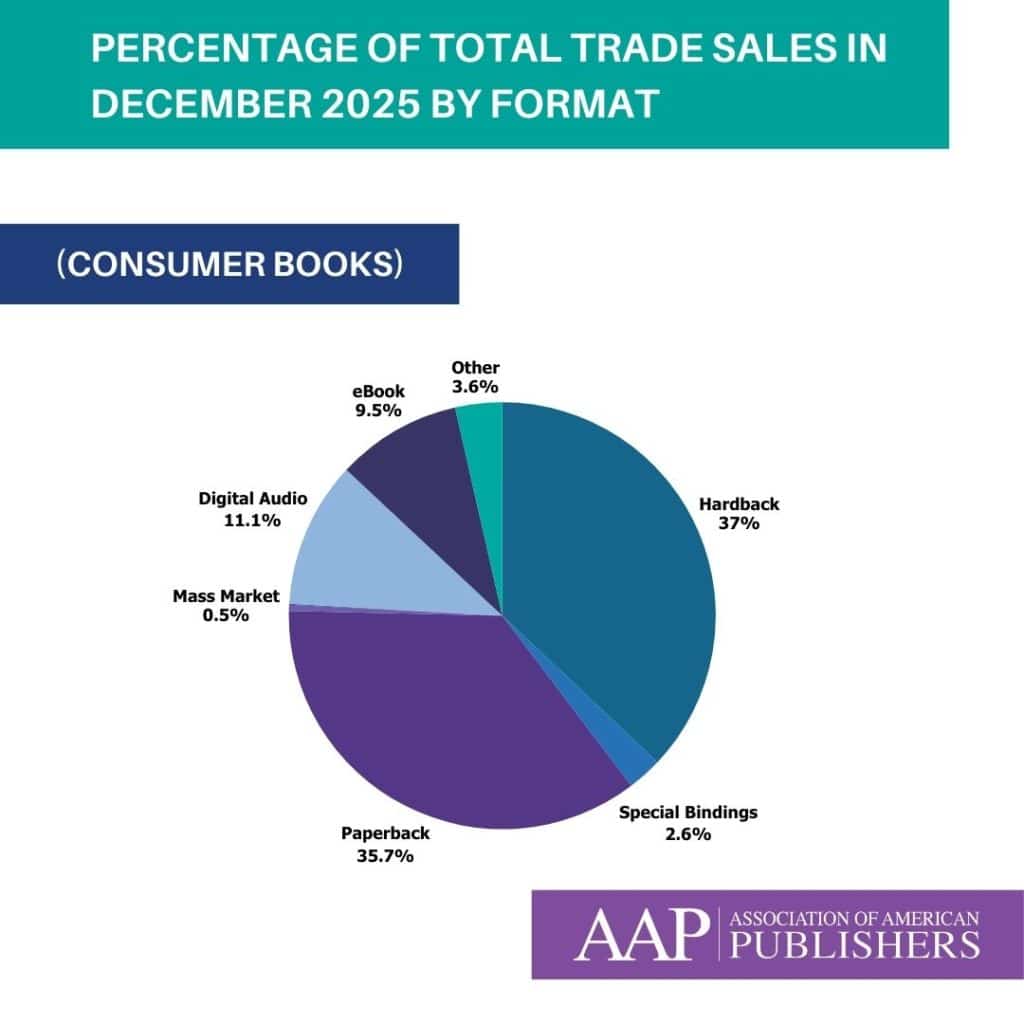

The Association of American Publishers (AAP) today released its StatShot report for December 2025, reflecting reported revenue for Trade (Consumer Books), Religious Presses, and Professional Publishing.

Total revenue across all categories for December 2025 was up 9.4% as compared to December 2024, coming in at $1 billion. Year-to-date revenues were up 1.1%, at $14.6 billion for the year.

Trade (Consumer Books) Revenues

December

Trade (Consumer Books) revenues were up 14.2% in December at $830.4 million. In terms of physical paper format revenues during the month of December, in the Trade (Consumer Books) category, Hardback revenues were up 13.5%, coming in at $307.6 million; Paperbacks were up 27.5%, with $296.3 million in revenue; Mass Market was down 61.6% to $3.9 million; and Special Bindings were up 13.8%, with $21.8 million in revenue.

eBook revenues were down 2.8% at $78.7 million for the month, and revenues from the Digital Audio format were down 0.8% for December, coming in at $92 million in revenue. Physical Audio revenues were up 11.3%, coming in at $500 thousand.

Year-to-date

Year-to-date Trade revenues were down 0.5% at $9.8 billion for the year. Hardback revenues were up 2.4% on a year-over-year basis, coming in at $3.7 billion; Paperbacks were down 3.4%, with $3.3 billion in revenue; Mass Market was down 29.2% to $84.9 million; and Special Bindings were up 0.3%, with $232.5 million in revenue.

eBook revenues were down 0.3% compared to 2024, for a total of $1 billion. The Digital Audio format was up 2.1%, coming in at $1 billion in revenue. Physical Audio revenues were down 31.2%, coming in at $6.1 million.

Religious Presses

December

Religious press revenues were up 16.8% in December, coming in at $78.4 million. Hardback revenues were up 18.7% to $46.6 million, while Paperback revenues were up 8.5% to $14.7 million. eBook revenues were up 4.7%, coming in at $3.6 million.

Year-to-date

On a year-to-date basis, religious press revenues were up 2.9%, at $926.4 million. Hardback revenues were up 2.9% at $577.5 million in revenue, Paperback revenues were down 4% to $158.4 million, and eBook revenues were down 0.3% at $49.9 million.

Professional Books

Professional Books, including business, medical, law, technical and scientific, were up 13.5% for the month, coming in at $42.5 million. Year-to-date, Professional Books’ revenues were $433 million, down 6.5% as compared to 2024.

AAP’s StatShot

AAP StatShot reports the monthly and yearly net revenue of publishing houses from U.S. sales to bookstores, wholesalers, direct to consumer, online retailers, and other channels. StatShot draws revenue data from approximately 1,300 publishers, although participation may fluctuate slightly from report to report.

StatShot reports are designed to give ongoing revenue snapshots across publishing sectors using the best data currently available. The reports reflect participants’ most recent reported revenue for current and previous periods, enabling readers to compare revenue on both a month-to-month and year-to-year basis within a given StatShot report.

Monthly and yearly StatShot reports may not align completely across reporting periods, because: a) The pool of StatShot participants may fluctuate from report to report; and b) Like any business, it is common accounting practice for publishing houses to update and restate their previously reported revenue data. If, for example, a business learns that its revenues were greater in a given year than its reports first indicated, it will restate the revenues in subsequent reports to AAP, permitting AAP in turn to report information that is more accurate than previously reported.